How to Boost Your Credit Score — Plus 3 Red Flags Fraud Might Be Dragging It Down

Repairing a low credit rating can save you thousands of dollars every year. So FIRST polled finance pros for easy ways to do it.

Yes, a high credit score can help you snag a great interest rate on loans and credit cards, but finance experts say it can also get you better prices on everything from cell phone plans to car insurance. In fact, in a recent cost comparison by Insurance.com, a female driver with poor credit was quoted 67 percent more a year for car insurance than a similar female driver with excellent credit.

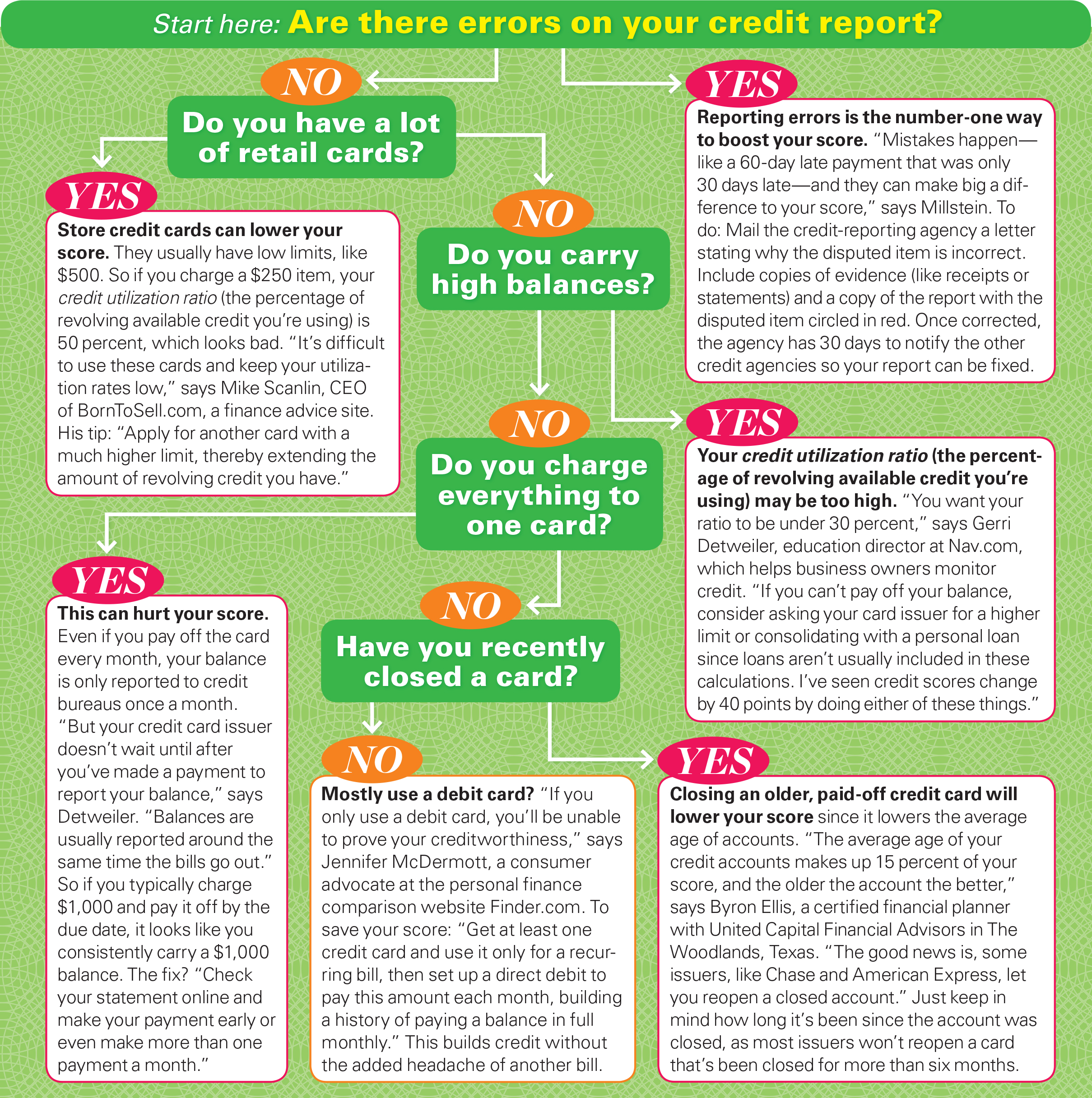

Ready to raise your score? “The first step is to be sure exactly where you stand,” says Steven Millstein from Credit Repair Expert, which reviews credit-repair companies. “Start by getting a free report at Annual Credit Report. This will help you figure out what you need to focus on, from errors on your report to carrying too high of a balance on one card.” Once you’ve figured that out, you can use the chart below to start your path to a higher credit score:

(Photo Credit: First For Women)

Now that you know how to boost your credit score, there’s still more you should do to protect your rating from dipping in the the future. In fact, a bad score might not even be your own fault — nearly half of Americans have been a victim of credit card fraud within the past five years. Here’s what to look for so you can protect yourself:

3 Red Flags of Credit Card Fraud

- On Your Credit Card Report: Look for inquiries from lenders that you never requested credit from. If you find any, contact the company that requested the credit check to get more information.

- On Your Bank Statement: Compare check numbers on your statement to the checks you actually wrote. Thieves often create dummy checks using your checking account and routing information.

- On Your Card Statements: Check weekly for any discrepancies — thieves often use small unusual amounts ($1.57 or 7 cents, for example) as a test before attempting a pricier transaction.

This article originally appeared in our print magazine.

More From FIRST

Looking for a New Credit Card? Here’s How to Pick the Best One for You