Looking for a New Credit Card? Here’s How to Pick the Best One for You

When it comes to plastic, we all know there is no one-card-fits-all. So FIRST polled finance pros to pinpoint the perfect card to fit your spending habits.

The number of credit cards on the market is dizzying. But choosing a card that meets your needs can lead to big payoffs. “I absolutely know from personal experience that choosing the right card can net you unbelievable rewards and save you hundreds of dollars a year, which can add up to thousands over a couple of years,” says Catey Hill, author of The 30-Minute Money Plan for Moms ($10.87, Amazon). “But most people don’t even know the benefits of certain cards — even cards they already have.”

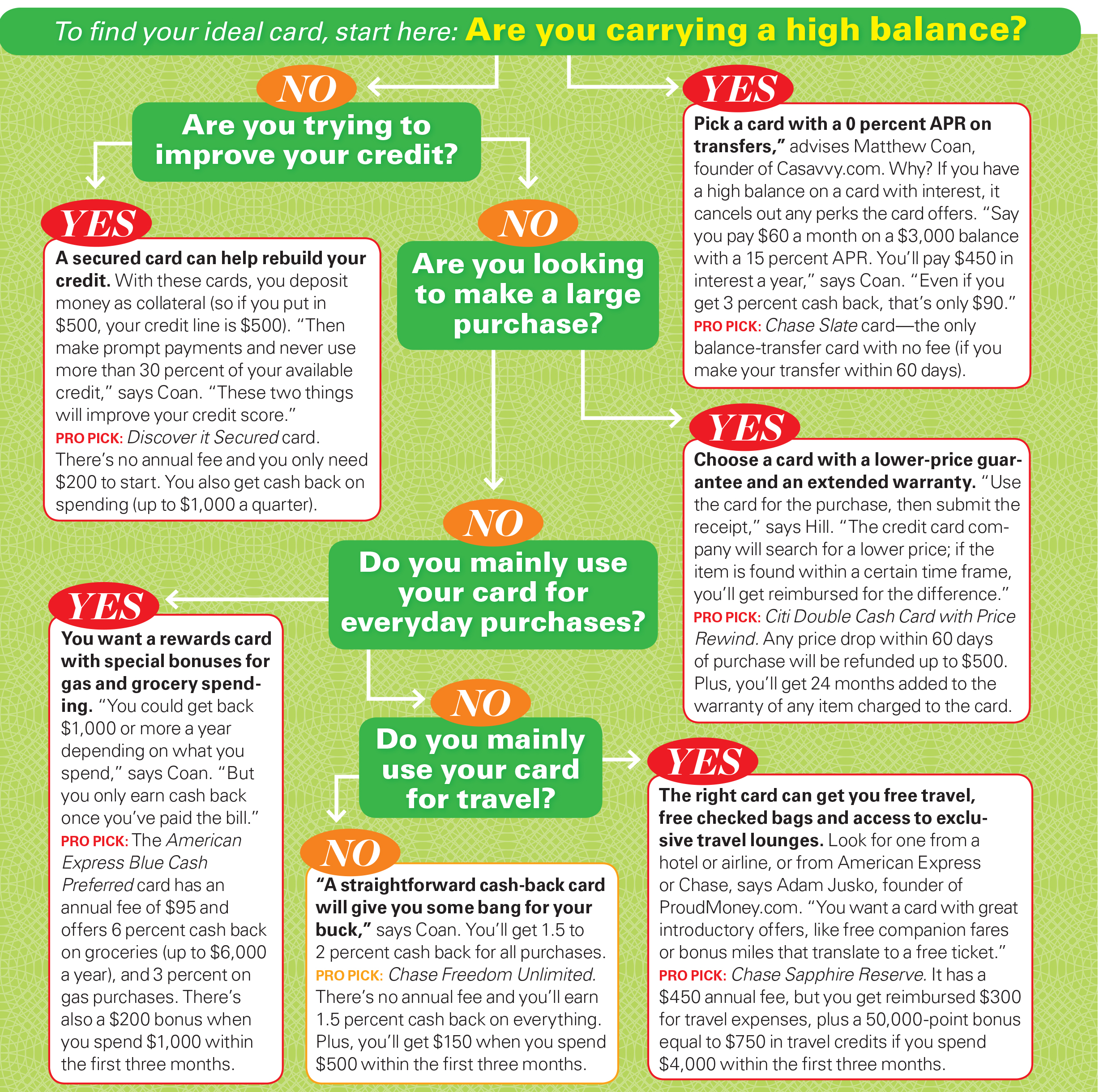

The good news: If you’re looking for a new card, you can narrow down your choices by answering a few simple questions. Just start at the top of the chart shown below and choose your charging style to discover the card that will help you save money and reap great perks.

(Photo Credit: First For Women)

Regardless of which type of credit card you choose, there’s one pesky issue that will always pop up: credit card fees. Keep reading for more tips on how to keep those fees from causing you to go broke.

Outsmart Credit Card Fees

The typical credit card has an average of six fees, but experts say you can avoid many of these unexpected charges without much effort. Here’s how:

- Late Charges: Whether you miss a payment because you forgot or because the due date changed (a common occurrence), call and ask for the fee to be reversed. In a CreditsCards.com survey, 87 percent of people who did so were successful.

- Annual Fees: If your card has an annual fee and your account is in good standing, call and ask for a refund. In the same CreditCards.com survey, 82 percent of cardholders who tried this got the annual fee waived or reduced.

- Paper Billing Charge: If you’re among the 54 percent of people who receive paper statements, you may see a “paper billing” fee each month in the “account summary” section. Eliminating the charge is as easy as switching to online billing.

We write about products we think our readers will like. If you buy them, we get a small share of the revenue from the supplier.

This article originally appeared in our print magazine.

More From FIRST

15 Amazon Secrets That Will Save You Money When You Shop